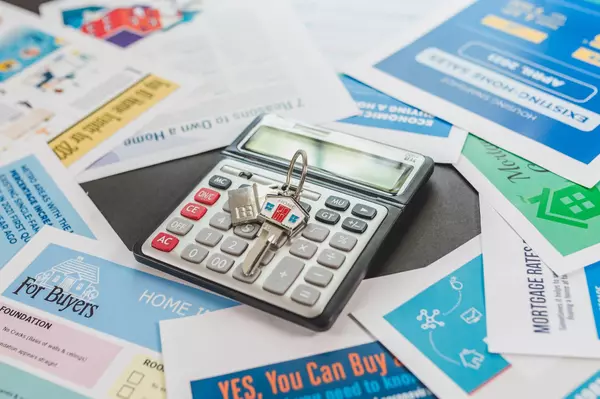

How To Invest In Real Estate For Passive Income

You're one Google search away from being overwhelmed by articles, blog posts, and videos on how to invest in real estate for passive income. Yet, with an abundance of information comes confusion. But fear not because we've consulted experienced New Orleans Realtors® and asked them for expert advice.

Should I Buy A Turn-Key Home Or A Fixer-Upper?

*2339 St. Thomas Street, Listed by Jennifer Gessner and Suzy Lamore Owning a home is typically an excellent investment. It appreciates over time and gives you equity to finance other loans down the road. Yet, high-interest rates, inflation and low inventory complicate dreams of owning a home. The m

How To Successfully Negotiate In A Seller's Market

In a real estate context, a seller's market occurs when the demand for homes exceeds the supply, often leading to competitive bidding wars and elevated home prices. For prospective buyers, it's crucial to know how to negotiate the price of a home to get the best possible deal. This blog post will wa

Categories

Recent Posts